One of the hidden gems of Vietnam right now is the venture builderSeedcom. The new venture capital portfolio has invested in over twelve companies already (and owns a massive 200-hectare piece of land in Vietnam’s highlands). All of these companies have some kind of connection to supply chain, retail, and ecommerce. One promising company in the mix is Haravan, Seedcom’s ecommerce platform startup

Understanding Haravan vs. Shopify

From the outside, Haravan (an alliteration of “Hai Ra Vang”, meaning to pick gold like you pick fruit) may resemble a Shopify for Vietnam. And indeed, at its core, its mission and the way it operates are fundamentally similar. This is from the Shopify website:

We focus on making commerce better for everyone, so businesses can focus on what they do best: building and selling their products. Today, merchants use our platform to manage every aspect of their business – from products to orders to customers, selling online, in retail stores, and on the go.

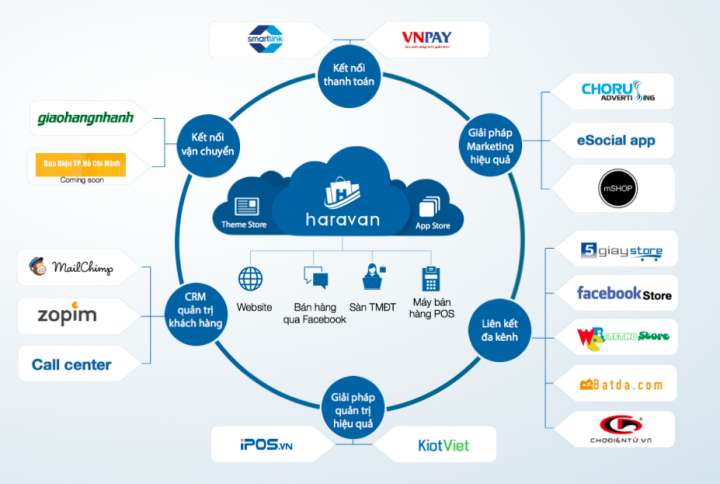

That’s precisely what Haravan is doing; it’s a platform for shops, retailers, and new SME ecommerce merchants to run their businesses offline and online. To the average Vietnamese user, it may look like a WordPress clone, where you can create a website using provided free and paid templates. But Haravan takes WordPress and Shopify’s basic core concept and expands on it considerably, placing it firmly into a Vietnamese context. This is rare in Vietnam, where copying is rampant but shallow. Haravan is a case where the cofounders identified a problem and then found a model that fit. They started with Vietnam’s burgeoning underserved SME ecommerce market, researched various models, and ended up with Shopify. The chart below outlines the model:

In detail, this means Haravan provides the following:

- Like Shopify, Haravan does all the basics. It has an API for third-party providers to create more features, it provides a POS platform for offline businesses to manage their inventory, marketing and ad integration, etc. etc.

- Haravan coordinates with local logistics companies to automatically provide logistics services to SME’s. Most notable of those is Giao Hang Nhanh, another Seedcom portfolio company (note that Giao Hang Nhanh also provides third party logistics services to Lazada and other large ecommerce contracts as well).

- Adjacent to Haravan’s logistics partners, the company also connects with prominent payment gateways like Smartlink and VNPay.

- Since most Haravan users are SMEs, managing customers can be unwieldy. They don’t have the resources to do it well. Thus, Haravan provides a full customer service toolset. This includes integrating email, newsletter, call center, and chat services into Haravan. Users can easily manage all of this through their dashboard.

- Given Vietnam’s forum-heavy social media space, Haravan provides forum integrationfor SMEs. This means Haravan works directly with forums to embed a store into forum comments. Sounds weird, right? Basically, if I am a shop owner, I can comment and have my store website embedded directly into a comment. The user interested in my products doesn’t even have to leave the forum to shop. Haravan works directly with forums like WebTreTho and 5giay (both among the top 30 most visited websites in Vietnam) to build the embedded ecommerce stores inside of their forums. The feature itself is interesting, but it underlines two of Haravan’s competitive advantages: 1) its five founders are all technical people that can think of and build these kinds of tools 2) Haravan’s leadership has the relationships to integrate SMEs into target markets their users need.

- In line with forum integration, Haravan provides Facebook crawling. Remember Page365 from Thailand? It helps Facebook Page sellers by crawling orders placed in comments and messages on their Facebook Page, and then organizes everything into a dashboard. Haravan does this as well.

On top of all these features, Haravan’s team understands the importance of literally hitting the ground running and has monthly events in Vietnam’s major cities to market and teach local merchants how to use Haravan. Their model is primed to be very down-to-earth, helping offline merchants, small ecommerce players, and the growing “omnichannelers”.

The Haravan story

It doesn’t take a genius to intuit that Haravan started with SMEs at heart. That’s because Huynh Lam Ho, one of the five cofounders of Haravan, tried his hand as a merchant originally. Huynh elaborates:

I started out selling stuff online but I wanted to start an offline store too. And with one store, it wasn’t bad, and after that we had this vision of opening ten stores in our second year. After the second quarter, we had three stores total. That’s when we started to feel the burn of managing inventory, customers, cost, suppliers, etc. With our small omnichannel operation we had to keep building tools to help ourselves. And we thought, I bet others have the same problem as us.

As Huynh ran up against this bottleneck while also building tools, Huynh was getting closer to Dinh Anh Huan, one of the five cofounders of The Gioi Di Dong (Mobile World, Vietnam’s largest mobile electronics retailer, which IPO’ed last year). Dinh shared Huynh’s concerns that many new merchants were running up against similar bottlenecks. Huynh goes on:

Dinh also had this sense that there were big problems for SMEs through his experience with The Gioi Di Dong. It was then that the team went looking for a system that could satisfy the needs we saw combined with the tools we already built. After searching through BigCommerce, Volusion, 3DCart, and Wix, we ended with Shopify. And the beauty for us with Shopify is that you could build with the community new tools and features customized for merchants and customers.

The Shopify model allowed for them to connect existing community bases they already knew. There were marketers who wanted to be merchants, and there were suppliers who wanted to sell. Merchants without marketing expertise could now interact with marketers or use the tools marketers have created. With this, they could solve multiple small and large problems new merchants had with growing their business. Thus, with the model identified, existing relationships to leverage, and a founding team of five engineers, Haravan began.

Haravan’s potential

One of Huynh’s key dreams for Haravan is that it can basically be a low-end outsourcer for everything merchants need. In the case of The Gioi Di Dong, as an omnichannel electronics retailer, it had to build an engineering team of over a hundred people. This is an impossible bottleneck and cost for smaller businesses who don’t have the capital nor the time to build a whole technical system and marketing channel for their products. Huynh hopes that Haravan can basically take care of engineering needs for all new merchants. In a sense, Haravan is more like an Alibaba business with a Shopify backend. Like Alibaba, Haravan wants to do everything it can to grow the influence and market of small businesses.

Haravan’s model and position make it compelling in Vietnam because of the current ecommerce climate. Large players like Zalora, Hotdeal, Lazada, Tiki, Vat Gia, and the looming empty threat of Vinecom make it hard to compete at a high level without a full-stack ecommerce team and a large amount of funding. Thus, there’s quite a few opportunities in waiting:

- The battle at the feet of the gods: The battle up at the top end means there’s still a large opportunity for smaller businesses to compete in niche categories that are underserved by juggernauts that are going for the mass market.

- Omnichannel Vietnam: As the common adage goes, that you’ll hear when talking to foreigners about Vietnam, “Vietnamese people are so entrepreneurial, I mean, look at all the shops”. Although this is a bit of a shallow assessment of Vietnam, it does point out something, there are Vietnamese shops everywhere, and a growing number of these shops want to get online. That means omnichannel is a massive opportunity. The success of The Gioi Di Dong alone underlines this.

- Generalizing to Southeast Asia: It’s easy to make the leap from Vietnam to the rest of Southeast Asia. Indeed, the rest of the region resembles this pattern of omnichannel leanings at the bottom and ferocious battling at the top. And the beauty is most of the features and tools that Haravan builds along its growth path will be customizable from market to market and also potentially translatable.

Haravan’s numbers reflect its potential. Since the official launch in September 2014 (and starting sales in December), Haravan has accumulated 24,000 free trial users, of which 1,700 (7 percent) are paying a monthly subscription fee of at least VND 170,000 (USD$8). The team is now more than 50 people.

Haravan’s growth remains to be seen, but if it can execute its vision successfully, it has a path to be one of Vietnam’s most influential companies in the next five years.

Source: Techinasia.com